Business to Business Supplies (B2B)

Selling Services

In the wake of the UK leaving the EU on 1 January 2021 the largest number of changes to VAT affect the movement of goods. For the vast majority of B2B service sellers the biggest change is that services supplied to EU customers are no longer zero-rated and are now subject to reverse charge. This means that they are outside the scope of VAT and fall into line with services sold to the rest of the world.

If you supply services to the EU the first thing you need to establish is which country’s rules apply. This is known as the ‘place of supply’. But do you need to follow the rules from where the services come from or where they are consumed? If you need to follow VAT rules in the customer’s Member State then you must check if you need to register for VAT and report taxes in that country.

For the majority the General Rule applies and remains the same post-Brexit.

What is the General Rule?

This applies to B2B services provided in the customer’s resident country when that falls outside of the UK. In this instance the service is outside the scope of UK VAT so is zero-rated. Your non-UK customer then uses a ‘reverse charge’ showing the VAT in their return.

You’re obligated to have evidence that your customer is resident outside of the UK - this can be a valid VAT or tax ID number from their country of residence.

This rule goes both ways i.e. if you are a recipient of services from an EU supplier then you will need to use a reverse charge.

Selling Goods

There are two main changes since 1 January 2021 that have VAT implications you need to be aware of.

- Intra-Community supplies (B2B) are no longer able to be zero-rated

UK companies will no longer be able to benefit from EU VAT laws that allowed them to zero-rate goods moving between Member States.

What does that mean for you?

Import VAT is now charged whenever you receive goods from EU countries, as with the wider world. It will need to be paid during the customs declarations, though you do have the option to defer the payment or make use of the Postponed VAT scheme.

- Distance Selling thresholds no longer apply.

Before Brexit, EU companies, including the UK, could charge their local VAT rates when selling to EU consumers as long as they were under a certain threshold. What does that mean for you?}

If you are selling goods directly to EU consumers you may need to register for an EORI number that starts with GB. This takes around 10 minutes, you can do it online and in most cases you’ll receive your number immediately. You may also need to register for VAT in the EU Member State.

EU Exports

What’s changed?

From 1 January 2021, UK businesses (including England, Scotland and Wales but not Northern Ireland) need to make customs declarations when they export goods to the EU.

You have the option to make the declarations yourself or you can use a freight forwarder, customers agent or courier.

Certain rules for exporting some goods have changed as of the 1 January 2021. These are in relation to:

- Export certificates and/or licences

- Marking, labelleing and marketing standards for plant seeds, manufactured goods and food

- Tobacco, certain oils and alcohol

The UK business will need to have an EORI number starting with GB to export goods from the UK. Goods that are exported from the UK will be zero-rated for VAT.

It’s important to make the EU business you’re dealing with aware that when importing goods they will need to prepare for changes that came into effect on the 1 January 2021:

- They will need to make customs declarations for the relevant Member State

- They need to check if they require a licence or certificate to import the goods into the relevant Member State

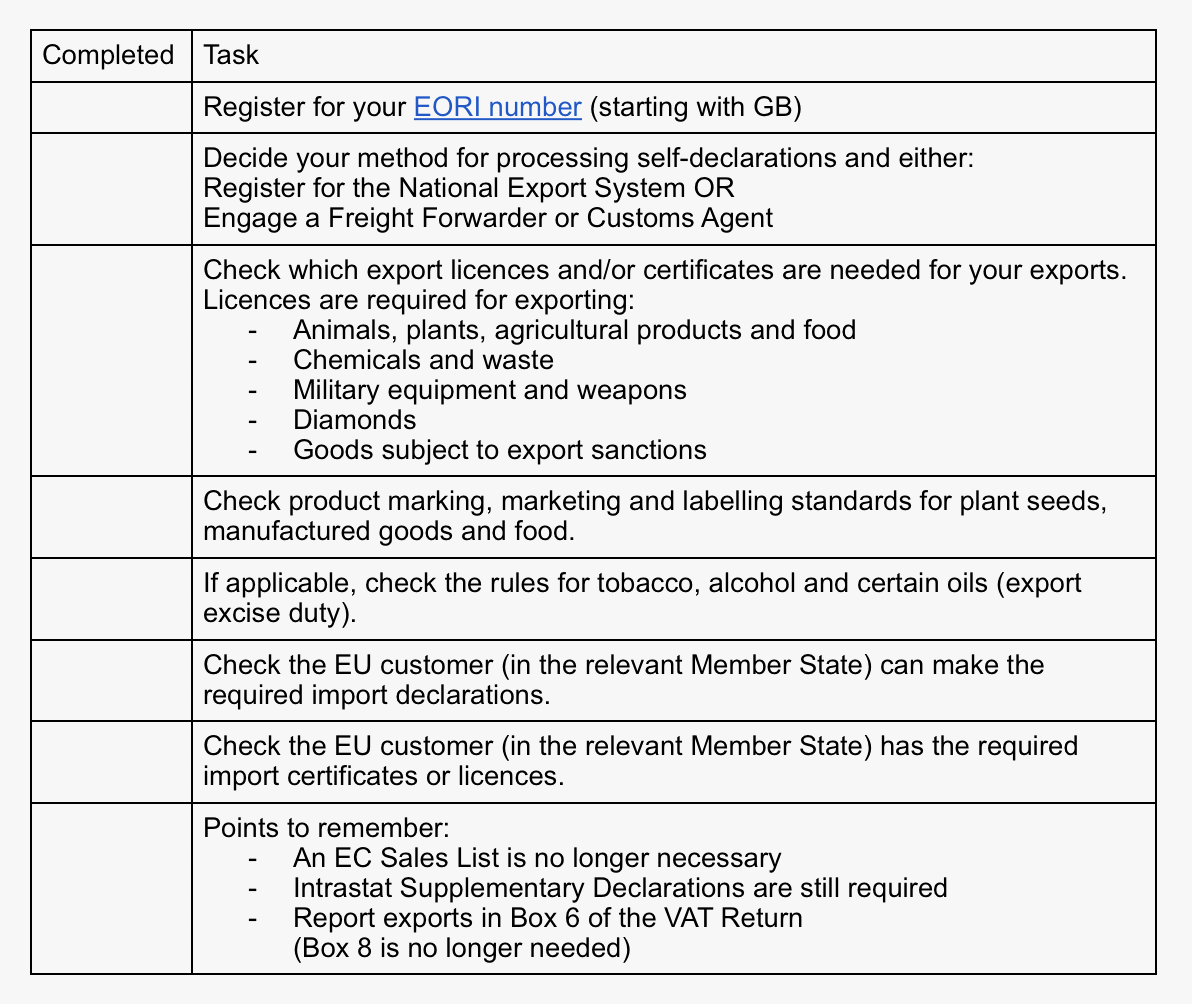

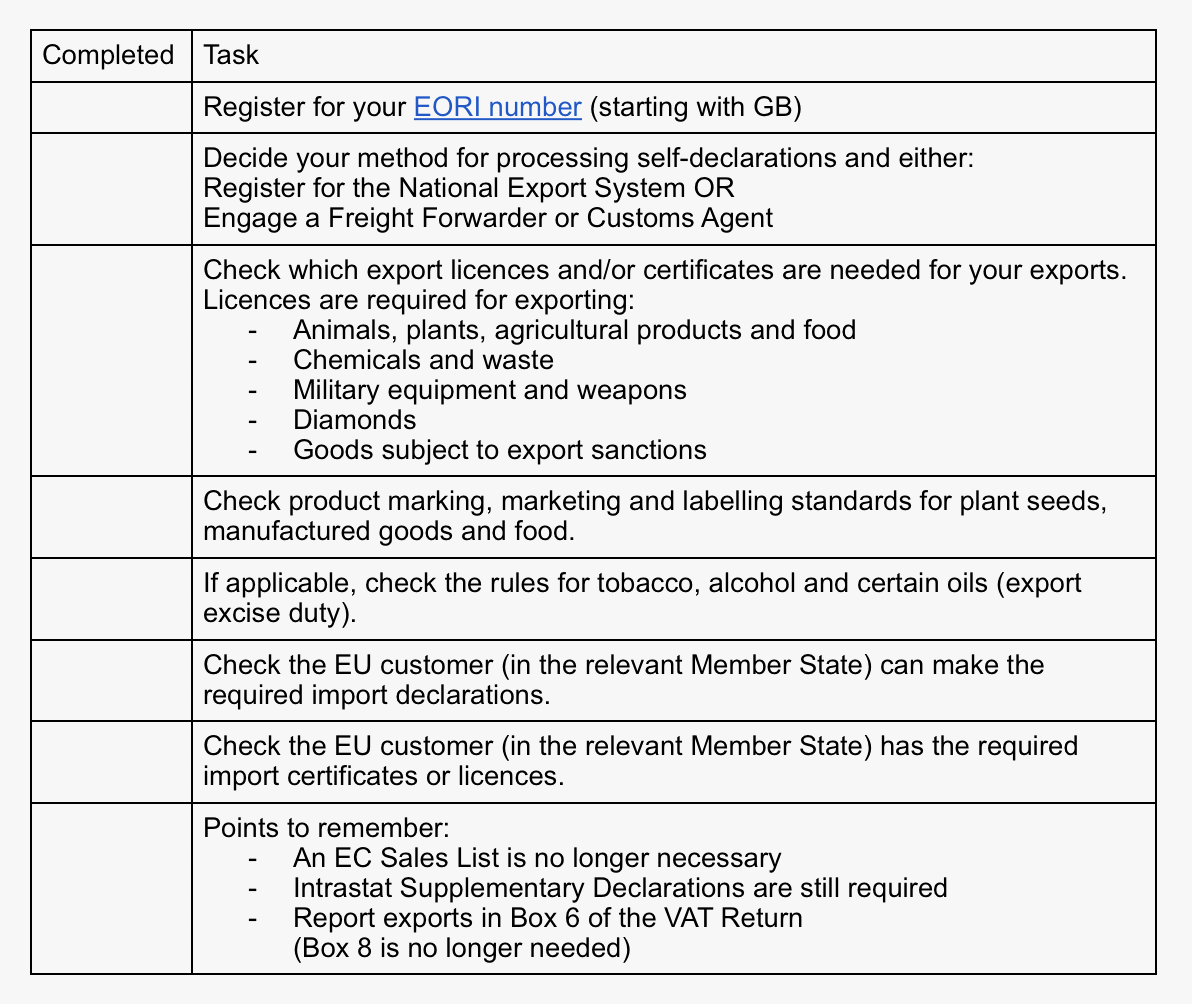

Handy exports checklist

We understand that there’s a lot of information to take in so here’s our quick checklist to work your way through:

EU Imports

1 January 2021 saw a number of changes come into effect for UK businesses importing goods from the EU. Businesses need to make customs declarations when importing goods from the EU into Great Britain (England, Scotland and Wales but not Northern Ireland).

You can make the declaration yourself or, alternatively you can engage a courier, customs agent or freight forwarder. All declarations are submitted electronically through the Customs Handling of Import and Export Frieght (CHIEF) system.

Rules for the import of certain types of goods also changed as of the 1 January 2021. These are in relation to:

- Export certificates and/or licences

- Marketing, labelling and marketing standards for plant seeds, manufactured goods and food

- Tobacco, certain oils and alcohol

All UK businesses will need an EORI number starting with GB to enable them to import goods from the EU. The UK business will need to pay customs duties and VAT on all imports.

There are some situations where a business can delay their declaration for up to 6 months after they import their goods.

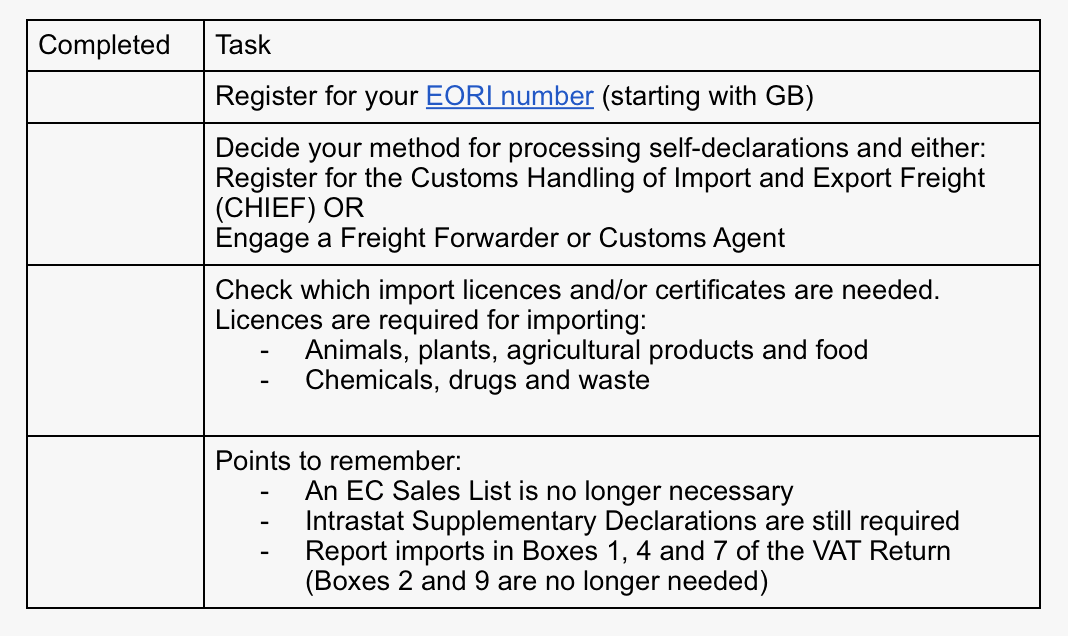

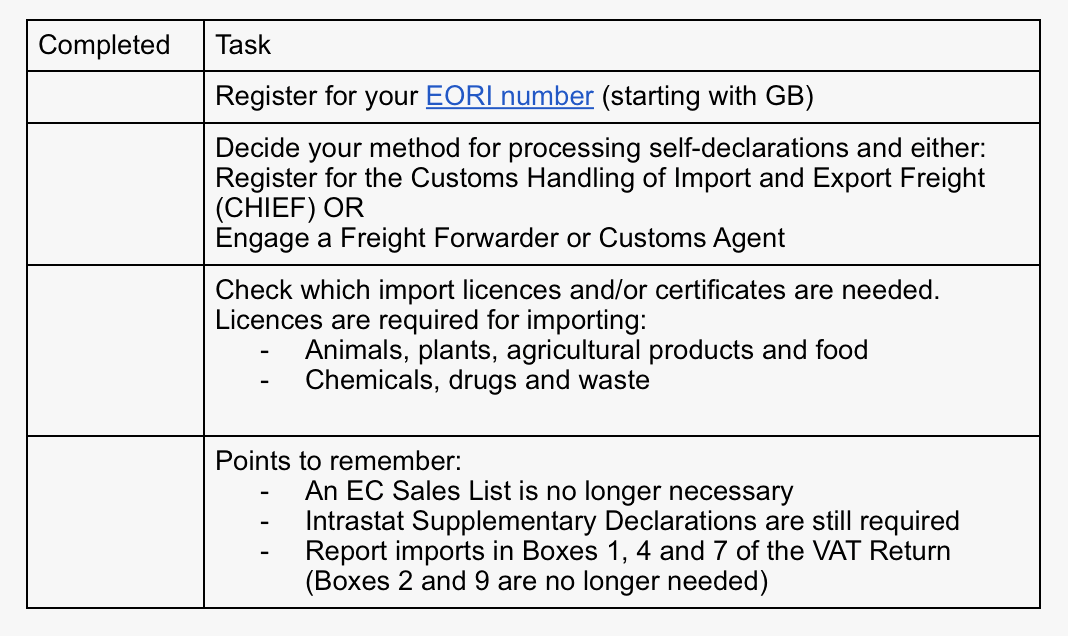

Handy imports checklist

We’ve pulled everything you need to do, or check, into one place to make it simple for you to check you’re compliant with all the changes to EU imports from 1 January 2021.

FAQs

Do I need a VAT registration in the EU to carry on trading?

You need to VAT register in each country if you do the following:

- Sell goods to the EU

- Use the VAT simplifications of triangulation, call-off stocks or distance selling

Do I need to appoint a fiscal representative when registering in the EU?

Overseas businesses without a local representative are required to appoint one in seventeen EU countries.

Do I pay the import VAT when the goods arrive in the EU or does it fall on the customer?

You need to check your delivery terms with your EU customers to see who it falls on to make the customs entry and pay import VAT and duty if applicable. Most EU countries have delayed accounting for import VAT. Germany, Italy, Slovakia and Cyprus don’t have this.

Has anything changed if I sell via Amazon?

If you use Fulfilment by Amazon (FBA) and sell to EU customers then you need to clear the goods into the EU and hold your goods there. This means that you’ll need to register for VAT in the EU.

Do I have an EORI number?

You need an EORI number that begins with GB to trade goods within the EU. Check your existing one and if needed apply online. It takes up to 10 minutes and you usually get your number immediately.

How do I choose the right tariff commodity code for my goods?

Generally, the tariff code used in the EU is replicated in the UK tariff. There might be different customs duty rates for each code so it’s worth double checking.

Do I need to pay customs duty when moving good between the UK and the EU?

Some goods now incur customs duty when moving them to and from the EU. If you’re unsure, double-check on GOV.UK. Speak to your customer if they’re liable to pay the duty to explain the change.

Will the EU recognise the UK’s regulatory standards if I sell food, medicine or certain services to the EU?

As it stands currently the UK has agreed that we will accept EU standards - with some additional documents needed at import into the UK. The EU hasn’t agreed to a similar policy at the moment so watch this space.

Disclaimer

Confused? That’s ok, it’s a complicated situation and we’re still awaiting further information and clarification. If in doubt it’s best to seek expert advice. We have customs and duty experts that we can put you in touch with, if you feel that’s the best step for you.

Business to Consumer Supplies (B2C)

The key point to note is that from 1 January 2021 Distance Selling no longer applies to UK businesses.

What is Distance Selling?

Distance Selling relates to the B2C supplies of goods. When goods are sold directly to a customer in another Member State than that is a distance sale. There’s a turnover threshold in each Member State, after which the business needs to register in that location. On 1 July 2021 the EU E-Commerce Package will be introduced which will simplify the registration and accounting process for EU Distance Selling. Until that point the current approach remains that in every Member State where the threshold is exceeded, you will need to register.

What does that mean for you?

From the 1 January 2021 any sales from UK businesses directly to EU consumers become exports which are zero-rated in the UK. They then become subject to local VAT, and potentially customs duty, in the Member State where the customer is located.

The customer will be responsible for paying the VAT and any duties due before the goods are released, unless the UK business takes action.

Part of the EU E-Commerce Package planned for the 1 July 2021 is a (Import) One-Stop Shop (OSS) which should simplify the process. UK businesses will register with the OSS if they are supplying goods directly to EU consumers. They will only have to be registered in one Member State and via the OSS VAT due in all 27 Member States will be accounted for.

It’s important to note that the 1 July 2021 is the published date for the One-Stop Shop currently. There is a possibility that this date could change. It’s best to keep an eye out for any updates or developments.

Online Sales of Goods to Private Customers in the EU

Until the end of June 2021, goods sent to private customers in the EU from the UK will be zero-rated exports. They will have import VAT due on arrival in the EU member state they are being sent to.

Any goods with a value under €150 (except tobacco, perfume and alcohol) and imported from a non-EU territory won’t be liable to customs duty when they are delivered directly to an end consumer in the EU.

This leaves you with three options:

- Manage the import process into the EU through your freight forwarder or express courier. They can manage the task and pay the import VAT (and customs duty if the value is more than €150) on the EU customer’s behalf. You would then reimburse your agent for the payment. You would need to check with your courier if you require an EU EORI number. It’s also worth noting that the EU import VAT isn’t recoverable as an input tax.

- You can leave the customer to liaise with their local Customs/tax authority to account for the import VAT and any customs duty. This can cause delays in the delivery of your goods and places the burden on your customer.

- Registering for VAT in the member state of the customer and procuring an EU EORI number allows you to import into the EU. If you charge domestic VAT to the customer it then allows you, as a UK seller, to hold stock in the EU to fulfil orders throughout the EU. Until the end of June 2021, you can utilise the distance selling thresholds to hold stock in one EU member state and dispatch to private customers in all other EU member states.

Current UK customs export declarations for postage and parcels to non-EU countries will now apply to movements to the EU.

There are significant implications around VAT for businesses when trading with the EU post-Brexit. The full details of the rules and procedures are still being announced, and are still subject to change. If you still feel unclear about what changes directly impact your business and how to navigate them then it’s best to seek professional advice. We empower businesses to take control of the circumstances and succeed. If you need help doing this send us a message and we’ll help you to understand what’s relevant to your business.